Filing your Income Tax Return (ITR) as a business owner or professional requires a combination of accuracy, documentation, and compliance with deadlines. Each year, many taxpayers face scrutiny or receive notices simply because of missing or mismatched information. Preparing the right documents in advance not only saves time but also ensures that your filing is error-free and compliant.

At JS Financial Services, with over 15 years of experience handling taxation and compliance for entrepreneurs and professionals, we have curated a detailed and practical ITR filing document checklist for AY 2025–26, based on years of real-world experience and best practices.

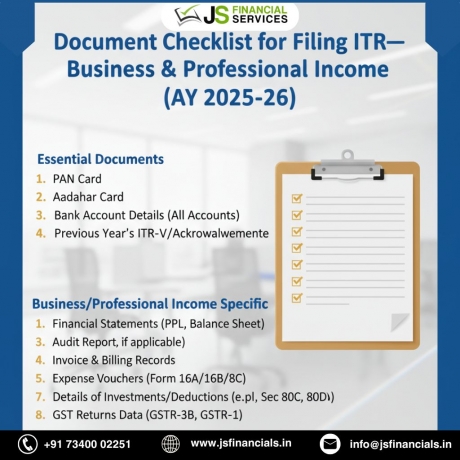

1. Personal and Basic Documents

Before starting the ITR filing process, make sure the following personal details and documents are up to date and accurate:

- PAN Card – Ensure your PAN is valid and linked with Aadhaar; failure to link may lead to an invalid return.

- Aadhaar Card – Mandatory for resident individuals and used for OTP verification while filing.

- Bank Account Details – Include account numbers, IFSC codes, and ensure the account is active. Refunds will be credited to these accounts.

- Updated Mobile Number and Email ID – The details linked with Aadhaar and income tax portal must be current for authentication and alerts.

- Passport – Required if you hold any foreign income, assets, or have undertaken overseas business transactions.

2. Financial and Business Statements

Your business's financial statements are the backbone of your ITR filing. These documents validate income, expenses, and overall financial position.

- Books of Accounts including:

- Balance Sheet

- Profit & Loss (Income-Expenditure) Statement

- Cash Book and Petty Cash Register – Maintain accurate closing balances as on 31st March.

- Bank Statements – Collect statements of all current and savings accounts used for business or professional transactions. These should be reconciled with your books of accounts.

3. Income, TDS and Tax Payment Proofs

It is essential to verify that all your income sources and tax credits are correctly reflected. Missing or incorrect entries can trigger automated system notices.

- Form 26AS – Download from the TRACES portal. It provides a consolidated summary of TDS, TCS, advance tax, and self-assessment tax paid, along with high-value transactions.

- Annual Information Statement (AIS) and Taxpayer Information Statement (TIS) – Available on the income tax portal; these reflect income from all sources and significant financial activities.

- Form 16A – Certificates of TDS deducted on professional fees, interest, or commission income.

- Tax Payment Challans – Proof of advance tax or self-assessment tax payments made through your bank portal.

4. Invoices, Receipts and Business-Specific Documents

Supporting evidence of your business income and expenses is essential for accurate reporting and deduction claims.

- Sales and Service Invoices – All invoices issued for services rendered or goods sold during the financial year.

- Expense Receipts and Bills – Rent, utilities, equipment purchases, repairs, software subscriptions, and other operational expenses.

- GST Returns and Payment Challans – For businesses registered under GST. These should align with your books of accounts.

- Government Grants or Subsidy Details – If any such benefits have been received, they must be disclosed.

5. Investment and Deduction Documents

Claiming the right deductions can optimize your tax liability and improve compliance. Keep the following proofs ready:

- Section 80C Investments – Public Provident Fund (PPF), Equity Linked Savings Scheme (ELSS), National Savings Certificate (NSC), and Life Insurance Premiums.

- Medical Insurance Premiums (Section 80D) – Receipts for health insurance payments for self and family.

- Education Loan Interest (Section 80E) – Statement from the financial institution.

- Home Loan Interest (Section 24b) – Certificate from the bank or lender.

- Donations (Section 80G) – Receipts and approval details for charitable contributions.

- Depreciation Schedules and Business Deductions – Documentation supporting depreciation claims or deductions for scientific research or business development.

- Rent Receipts and Agreements – Required if you are claiming HRA or showing income from house property.

6. Asset, Property, and Liability Details

If your total income exceeds ₹50 lakh, the Income Tax Department requires a detailed declaration of assets and liabilities.

- Asset-Liability Schedule – Include all immovable properties, movable assets such as vehicles, jewellery, and investments, along with liabilities and loans.

- Capital Gain Statements – From your broker or registrar, if you have transactions in property, mutual funds, or listed shares.

- Loan and Overdraft Statements – From banks or NBFCs reflecting outstanding balances and interest paid.

7. Other Essential Proofs

Some cases require additional documentation, especially where audits or professional taxes are involved.

- Audit Report and Related Certificates – Mandatory if your business turnover exceeds the prescribed limit and falls under a tax audit.

- Professional Tax Receipts – Applicable in some states for self-employed professionals.

- Previous Year's ITR and Acknowledgment – Useful for reference and carry-forward of losses or depreciation.

Latest Compliance and Filing Updates for AY 2025–26

Keeping track of deadlines is crucial to avoid penalties and late fees. Below are the current statutory dates for the Assessment Year 2025–26:

- Deadline for Non-Audit Cases: 15 September 2025

- Deadline for Audit Cases: 31 October 2025

- Deadline for Belated/Revised Returns: 31 December 2025

- PAN–Aadhaar Linkage: Mandatory; unlinked PANs will render ITRs invalid.

- Enhanced Reporting: Applies to capital gains, high-value transactions, and certain deductions or allowances.

It is highly recommended to reconcile your AIS and Form 26AS carefully before submission to avoid mismatches or system-generated tax notices.

Pro Tips from JS Financial Experts

- Do not depend solely on digital records such as AIS or Form 26AS. Cross-verify them with physical invoices and receipts.

- Reconcile every bank statement and ledger entry with your reported income and expenses. This is especially important if your business is subject to audit.

- Double-check eligibility for deductions under both the old and new tax regimes, and ensure you file Form 10-IEA if opting for the new regime.

- Maintain both digital and hard copies of all tax-related documents for at least seven years to support audit or verification processes.

Conclusion

Filing an accurate and compliant ITR for business or professional income requires proper documentation, attention to detail, and adherence to timelines. By following this checklist, taxpayers can ensure a seamless filing process while minimizing the chances of errors or scrutiny.

If you need expert guidance in reviewing your documents, reconciling statements, or filing your return efficiently, JS Financial Services provides complete tax and compliance support for businesses and professionals across India.

Contact JS Financial Services

480-481, Vivek Vihar, New Sanganer Road, Jaipur – 302019

+91 73400 02251

info@jsfinancials.in

www.jsfinancials.in

Our Expertise, Your Success.